Credit scores can feel mysterious and intimidating, leading many people to rely on advice that’s more myth than fact. One of the most persistent misconceptions is the idea that you must carry a balance on your credit card—meaning, not pay it off in full each month—to build or improve your credit score.

Let’s break down where this myth comes from, what the truth actually is, and how you can use your credit card wisely to boost your score.

Why People Believe It

The myth that you need to carry a balance each money likely stems from misunderstandings about how credit scores are calculated and how credit cards work.

Here are a few reasons why this belief is so common:

- Confusion Over Credit Utilization: Many people know that using your credit card and having some activity is good for your score. This gets misinterpreted as needing to leave a balance on the card, rather than simply using the card and then paying it off.

- Anecdotal Advice: Friends, family, or even some misinformed financial professionals may have repeated this advice, making it seem credible.

- Misunderstanding Interest Charges: Some believe that paying interest (which only happens if you carry a balance) is somehow rewarded by credit bureaus, when in reality, it only benefits the credit card company.

- Credit Card Marketing: In the past, some credit card companies may have been less than clear about how to use credit responsibly, leading to confusion.

The Reality

You do not need to carry a balance on your credit card to improve your credit score. In fact, carrying a balance can hurt your finances by costing you money in interest payments, and it does nothing to help your score.

Here’s what actually matters for your credit score:

- Payment History (35% of your score): The single most important factor is making on-time payments. Paying your full balance each month demonstrates responsible use and builds a positive payment history.

- Credit Utilization (30%): This refers to the percentage of your available credit that you’re using. It’s best to keep this below 30%—but you can do this by paying off your balance in full before your statement closes or by making multiple payments each month.

- Length of Credit History, Credit Mix, and New Credit (the remaining factors): These are influenced by how long you’ve had credit, the variety of accounts, and how often you apply for new credit—not by carrying a balance.

Carrying a balance does not help your score. According to FICO and Experian, two of the major credit scoring agencies, you only need to use your card and pay it off on time to build credit. You don’t need to run a balance and pay interest.

In fact, carrying a high balance can increase your credit utilization ratio, which may actually lower your score.

Okay, so how can I raise my credit score?

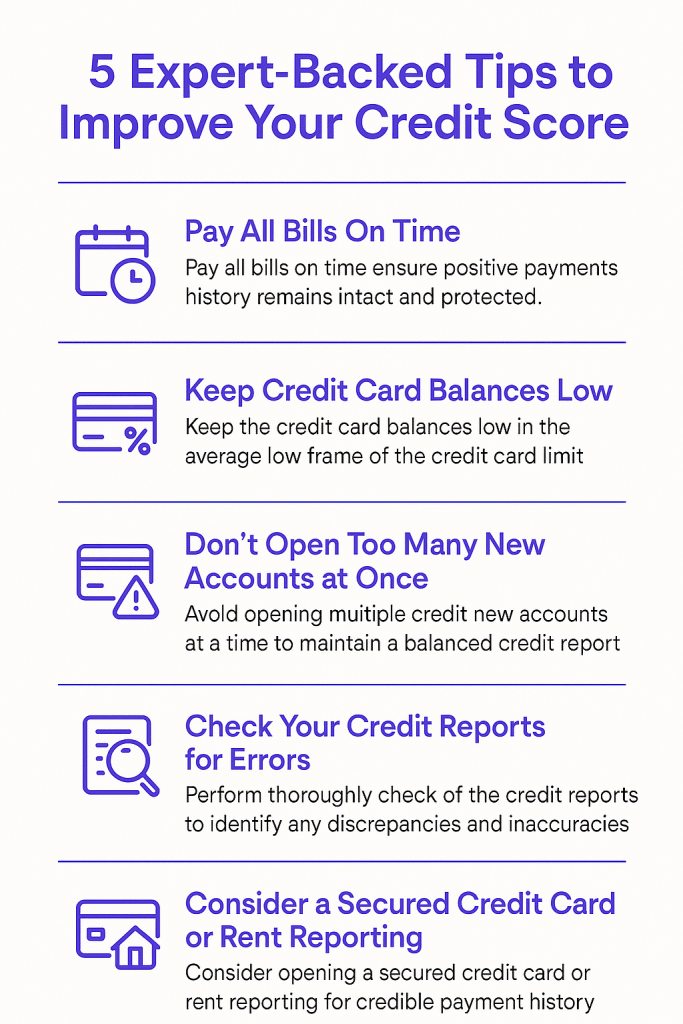

Here are five expert-backed tips to help improve your credit score:

- Pay All Bills On Time

Your payment history is the single most important factor in your credit score. Set up automatic payments or reminders to ensure you never miss a due date. - Keep Credit Card Balances Low

Aim to use less than 30% of your available credit limit. Lower credit utilization signals to lenders that you manage credit responsibly. - Don’t Open Too Many New Accounts at Once

Applying for multiple new credit lines in a short period can lower your score and make you appear risky to lenders. - Check Your Credit Reports for Errors

Regularly review your credit reports and dispute any inaccuracies you find. Mistakes can unfairly drag down your score. - Consider a Secured Credit Card or Rent Reporting

If you’re new to credit or rebuilding, a secured credit card or services that report rent and utility payments can help you establish positive credit history.

Sources:

Expert Tip

Use your credit card for regular purchases, but pay the full statement balance every month. This way, you build a strong payment history and keep your credit utilization low—two of the biggest factors in your credit score—without ever paying a cent in interest.

If you want to maximize your score:

- Make small, manageable purchases on your card each month.

- Pay the balance in full before the due date.

- Monitor your credit utilization, especially if you plan to apply for a loan soon.

Bottom line: You don’t have to pay interest to build good credit. Responsible use and full, on-time payments are all it takes.

Remember: Don’t let this myth cost you money. Use your credit card as a tool for building credit, not as a source of unnecessary debt.