The belief that only high earners can save and invest is widespread, but it’s a myth that can hold people back from building financial stability.

In reality, consistent saving and investing are possible—and effective—at nearly any income level. It’s how people build wealth, regardless of their income.

Remember: It’s a myth that all high-income people are wealthy.

Why People Believe It

Many people equate wealth-building with high salaries, assuming that only those with substantial incomes have “extra” money to set aside.

Did you know that Dave Ramsey found that nearly 1/3rd of millionaires never earned more than $100,000/year? And almost 80% of millionaires didn’t receive an inheritance either.

This misconception is reinforced by images of wealthy investors and stories of people who became rich through large investments, making it seem like saving and investing are out of reach for the average person.

Additionally, the pressure of everyday expenses and debt can make saving feel impossible, especially for those living paycheck to paycheck.

The Reality

Here’s the truth: You don’t need to be wealthy to invest. On the contrary, investing is how the vast majority of people get wealthy.

Even small, regular contributions can add up significantly over time thanks to the power of compounding interest.

Many financial institutions and investment platforms now offer low or no minimums, making it easier than ever for anyone to begin investing—even with just a few dollars.

Studies and expert advice show that what matters most is consistency and time in the market, not the size of each contribution.

So, how can you build wealth without a high salary?

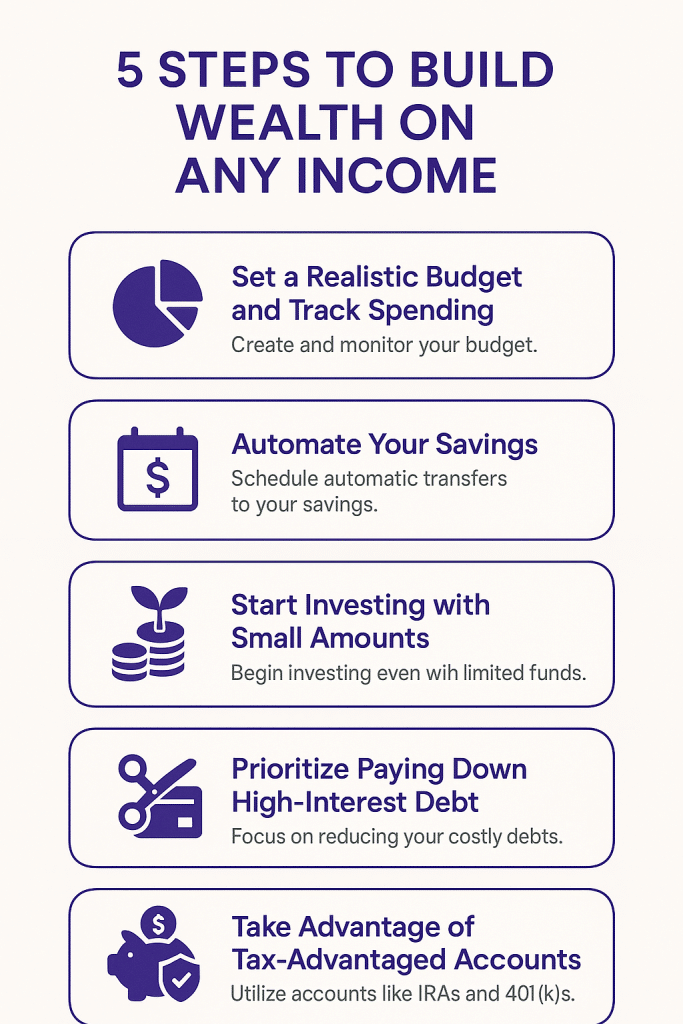

Here are five practical tips to build wealth through saving and investing, without a high salary:

- Set a Realistic Budget and Track Spending

Carefully track your income and expenses to find areas where you can cut back, even if only by a small amount. Use budgeting methods like the 50/30/20 rule to consistently allocate money toward savings and investments. - Automate Your Savings

Set up automatic transfers to a savings or investment account each payday. Automating this process helps you build wealth consistently and reduces the temptation to spend what you might otherwise save. - Start Investing with Small Amounts

You don’t need a lot to begin investing. Use micro-investing apps or low-cost index funds and ETFs to start building your portfolio, taking advantage of compound growth over time. - Prioritize Paying Down High-Interest Debt

Focus on eliminating high-interest debt, such as credit cards or payday loans. Reducing debt frees up more of your income for saving and investing and improves your overall financial health. - Take Advantage of Tax-Advantaged Accounts

Contribute to retirement accounts like a 401(k) or IRA, even with small amounts. These accounts offer tax benefits that help your money grow faster and can make a significant difference over time.

Expert Tip

Start by saving or investing whatever amount you can, no matter how small.

Set up automatic transfers to a savings or investment account to make the process effortless and consistent. Over time, increase your contributions as your financial situation improves.

Remember, the key to building wealth is not how much you make, but how consistently you save and invest, and how long you allow your money to grow.

Bottom line: You don’t need a high income to build wealth—consistent saving, smart budgeting, and starting to invest early with whatever you can afford are the real keys to long-term financial success. Small, steady steps can lead to big results over time.