Credit cards often get a bad rap, with one of the most common pieces of advice being, “Never use credit cards because the interest rate is high.”

While it’s true that credit card interest rates are among the highest of any mainstream financial product, this blanket statement ignores how credit cards actually work—and how responsible use can bring significant benefits without ever paying a cent in interest.

And, responsible credit card use is a great way to boost your credit score, too.

Why People Believe It

There’s good reason for concern: as of May 2025, the median average credit card interest rate is 24.20%. This is significantly higher than most other forms of borrowing, such as mortgages or auto loans.

Stories of people falling into debt traps, paying hundreds or even thousands in interest, and struggling to pay off balances reinforce the idea that credit cards are inherently dangerous.

Financial experts and family members often warn against credit cards, emphasizing horror stories about compounding interest and lifelong debt. This advice is usually well-intentioned, aiming to protect people from the very real risks of carrying a balance at such high rates.

But there’s another side to the story—credit cards can actually be one of the smartest ways to make purchases when used wisely.

The Reality

While credit card interest rates are high, they only apply if you carry a balance from month to month.

Most cards offer a grace period: if you pay your full statement balance by the due date, you pay zero interest on purchases.

In this way, credit cards can be used as a convenient, secure payment tool with no cost at all.

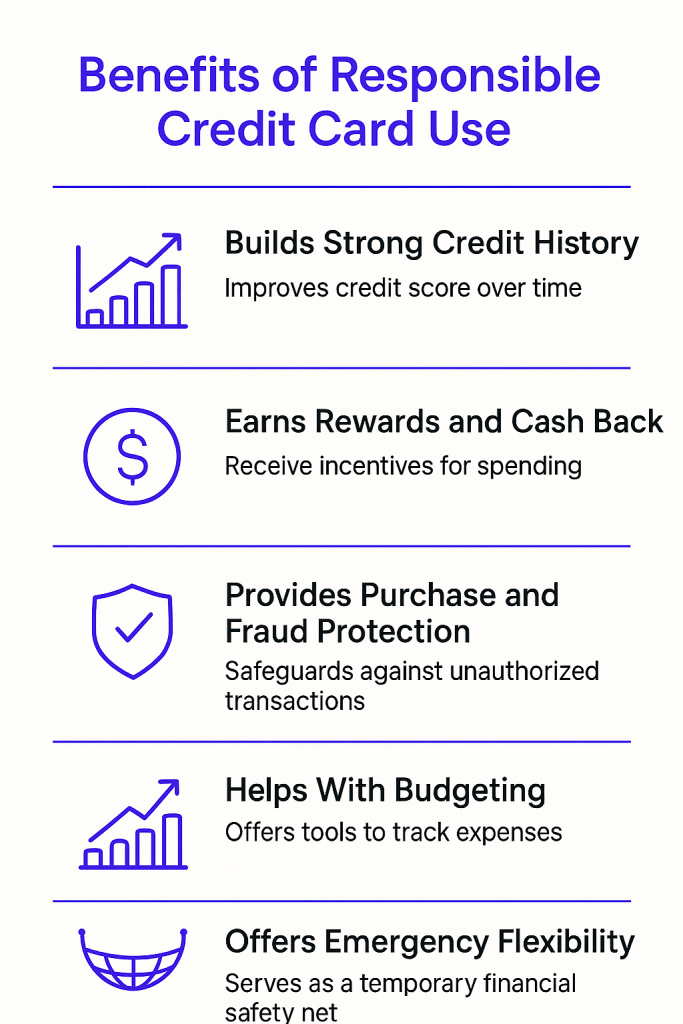

Responsible credit card use offers a range of valuable benefits that go far beyond just making purchases. Here’s a closer look at why using credit cards wisely can be a powerful part of your financial toolkit:

- Builds Strong Credit History: Making regular, on-time payments helps establish and improve your credit score, which is essential for qualifying for loans, mortgages, and even some jobs or rentals in the future. A positive credit history demonstrates to lenders that you’re a reliable borrower.

- Earns Rewards and Cash Back: Many credit cards offer rewards programs, such as cash back, travel points, or retail perks. When you pay your balance in full each month, you can enjoy these benefits without paying interest, effectively getting rewarded for your everyday spending.

- Provides Purchase and Fraud Protection: Credit cards often include protections like zero liability for unauthorized charges, extended warranties, and dispute resolution for faulty purchases, giving you extra peace of mind when shopping online or in stores.

- Helps With Budgeting and Tracking Spending: Credit card statements provide a detailed record of your purchases, making it easier to track spending, set budgets, and identify areas where you can save.

- Offers Emergency Flexibility: In a pinch, a credit card can serve as a short-term safety net for unexpected expenses, buying you time to cover costs without immediately draining your savings—provided you pay off the balance quickly.

The key to unlocking these benefits is using your card responsibly: pay your bill on time and in full, keep your credit utilization low, and avoid unnecessary debt. When managed wisely, credit cards can help you build credit, earn rewards, and strengthen your overall financial health.

For those who do need to carry a balance, there are options like low-interest or 0% introductory APR cards that can help manage costs in the short term.

But the key is to avoid revolving debt whenever possible.

Expert Tip

Use Credit Cards as a Tool, Not a Loan

Experts agree: Credit cards are best used for convenience and benefits—not for long-term borrowing.

Always aim to pay your balance in full each month to avoid interest charges entirely.

Set up automatic payments or reminders to help you stay on track. If you must carry a balance, look for cards with the lowest possible APR and make a plan to pay off your debt quickly.

Bottom line: High interest rates are a real risk, but they’re only a problem if you carry a balance. With responsible use, credit cards can be a valuable part of your financial toolkit—not something to fear or avoid entirely.